For people who stand on the sideline, it seems that the turbulence in the crypto market never ends. Yet, unaffected by the market sentiment, the believers continue to build, including large traditional finance players.

Matt Huang is not wrong. While crypto theatre continues to dominate media headlines, the serious players see the true value of a blockchain infrastructure through the chaotic front. Before you realize it, the institutional DeFi is already here.

Infrastructure advantages of DeFi vs. TradFi

Some of the key infrastructure advantages of DeFi:

Real-time settlement. No matter sending money or trading stocks, it is normal to take 1 – 3 days to settle in a traditional finance setting. This is because, in TradFi, there are multiple technological systems/intermediates between the sender and receiver. Going through each of these systems takes time. On a blockchain, however, the transactions take seconds rather than days, with all transaction history recorded on chain. This is even more powerful in lending and borrowing. Taking out a personal loan with any bank is a painful process that can take from days to months. Not to mention the hurdles you need to overcome for a business loan. With DeFi protocols, a loan can be executed in the same amount of time as any other transaction. Real-time settlement also reduces risks of failure or fraud.

Cut costs to near zero. Until this day, if I want to wire transfer money in the USA, it costs about $25 for the sender and $15 for the receiver. In the UK, you just need to replace $ with £. On blockchain, you can benefit from a 99% cost cut performing the same transaction activities. No fee for receivers. I never understand why the receivers with a traditional bank account need to pay fee until this day.

Liquidity aggregation means improved liquidity. Liquidity pools on the same chain can be aggregated. With improved interoperability, pools on different chains can be aggregated as well for better liquidity. On-chain aggregation of different asset classes and markets encourages further product innovation and creates a more integrated financial market.

Real-time collaboration among different parties. Recurring executions can be turned into codes and written into smart contracts. Programmatic execution empowers automation of multi-party operational activities all at once. This reduces operational overhead (e.g. trade reconciliation) and minimize human errors.

DeFi in numbers

As of 29 April 2023, the total value locked (TVL) in DeFi protocol is around $50 billion. At its peak, the number surpassed $180 billion. Lido, the largest ETH liquidity staking protocol tops the list with $12 billion TVL, followed by two lending protocols MakerDAO ($7.44 billion) and AAVE ($5.36 billion).

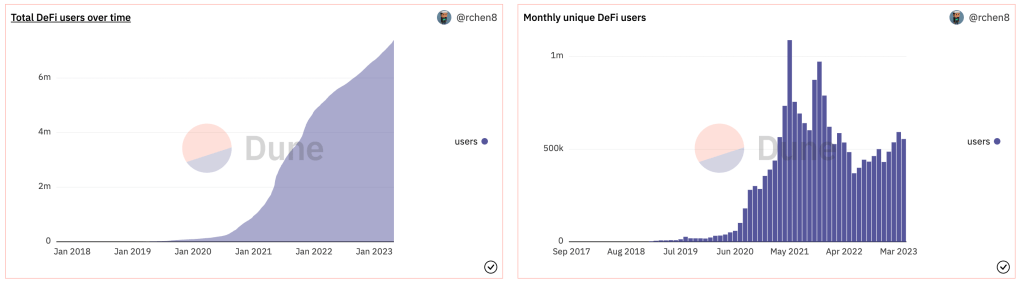

In terms of users, the number of DeFi users broke one million mark in January 2021. Today the total number of users that interacted with DeFi protocols stands above 7.3 million. It took 749 days to reach one million users, and it took about the same time to 7x the number. Slowly, slowly, then suddenly.

Where Institutional DeFi differ

Compared to the native DeFi projects, the institutional DeFi differ in the two main ways.

Digital representation of real-world assets. The first and foremost difference is that Institutional DeFi works with tokenized real-world assets rather than digital native tokens. Already, we see MakerDAO issuing DAI with US treasuries as collaterals. JP Morgan has also completed a transaction on Onyx Digital Assets using tokenized ownership interests in Money Market Fund (MMF) shares as collateral. And we are just getting started. The traditional real estate market is around $344 trillion, the equity market is around $122 trillion. The crypto market at its prior peak was only $3 trillion and is now around $1.2 trillion.

Safeguarding measures are in place. If you haven’t been scammed in DeFi then you are not a true DeFi OG. Without regulation, DeFi is the wild west with plentiful opportunities and same amount of risks. The risk level in current DeFi world is extremely high and very challenging for institutional investors who often hold millions of people’s money. The safeguarding measures include a range of topics such as AML/KYC procedures, data privacy, cybersecurity, proper governance structure and legal clarity around smart contract-based business activities. Without significant breakthrough on this topic, DeFi will remain a child’s play.

Leading companies on Institutional DeFi

JP Morgan Onyx

Jamie Dimon’s early criticism on bitcoin has not stopped the bank to pioneer the blockchain use cases in traditional finance. In fact, JP Morgan has one of the most advanced digital infrastructures among all banking players. J.P. Morgan Onyx is a blockchain-based platform developed by the bank to facilitate faster and more secure cross-border payments. The platform leverages blockchain technology to enable real-time transfers of funds between institutions, reducing the time and costs associated with traditional correspondent banking.

Onyx has several features that make it stand out from other blockchain-based payment platforms. These include its ability to handle a high volume of transactions, its flexibility to support different payment types and currencies, and its use of smart contracts to automate payment flows and reduce the need for manual intervention.

J.P. Morgan Onyx has been used in several high-profile transactions, including a recent pilot with Singapore’s central bank to facilitate cross-border payments with other central banks.

Metamask

Metamask, a popular Ethereum wallet with 20 – 30 million monthly active users, has been playing an increasingly important role in institutional DeFi. With the rise of decentralized finance (DeFi), institutional investors have shown growing interest in the potential benefits of this new ecosystem. However, the decentralized nature of DeFi platforms can be challenging for traditional investors to navigate.

Metamask provides a solution by offering a user-friendly interface that allows institutional investors to access DeFi applications and services directly from their existing wallets. This simplifies the onboarding process and makes it easier for institutions to interact with DeFi protocols without needing to build their own custom infrastructure.

In addition, Metamask’s integration with institutional-grade custody solutions, such as Anchorage and BitGo, provides added security and compliance for institutional investors. This makes it easier for them to meet regulatory requirements while still gaining exposure to the potential benefits of DeFi, such as high yields and greater liquidity.

Avantgarde Finance

Avantgarde Finance is a DeFi infrastructure company that provides the tool kits to 1) enable onchain treasury management with a DAO governance structure and 2) provide asset management services via Enzyme Finance. The platform is built on the Ethereum blockchain and offers a range of services, including staking, yield farming, and liquidity provision.

Avantgarde Finance also provides its users with access to low-cost financing opportunities through its decentralized lending platform. This allows users to borrow funds without the need for a middleman or credit check. Additionally, the platform offers a range of analytics and insights, such as price and market trend analysis, to help users make informed decisions. Finally, users can also benefit from Avantgarde Finance’s advanced security measures, which are designed to protect their funds and reduce fraud risk.

Founded by Mona Elsa, a former star Goldman trader turned entrepreneur, Mona has deep expertise in both traditional finance and DeFi. At its peak, Avantgarde/Enzyme has $200mm+ AUM onchain.

Maple Finance

Maple Finance is a decentralized finance (DeFi) platform that aims to bring institutional-grade lending to the world of DeFi. The platform offers a decentralized and permissionless way for borrowers to access capital and for investors to earn fixed income returns by lending their assets.

One of the key features of Maple Finance is its underwriting process, which is designed to provide a high level of security and risk management that is suitable for institutional investors. The platform uses a community-led approach to underwriting, where investors can participate in due diligence and help assess the creditworthiness of borrowers. This ensures that only high-quality borrowers are approved for loans, reducing the risk of default and protecting investor capital.

Another important feature of Maple Finance is its focus on transparency and compliance. The platform is built on the Ethereum blockchain, which allows for a high level of transparency and auditability. In addition, Maple Finance is designed to comply with regulatory requirements, making it more accessible to institutional investors who require a higher level of compliance.

Qredo

Qredo is a blockchain infrastrucuture company that is focused on providing secure and scalable solutions for decentralized finance (DeFi) and digital asset custody. The platform uses multi-party computation (MPC) technology to enable secure key management and transaction signing for institutional clients.

One of the key features of Qredo’s platform is its focus on privacy and confidentiality. The platform is designed to ensure that sensitive data, such as private keys and transaction details, are kept confidential and secure. This is achieved through a combination of MPC technology and advanced cryptographic protocols, which ensures that no single party has access to the entire key or transaction data.

Another important feature of Qredo’s platform is its scalability. The platform is built on a sharded architecture, which enables it to handle a high volume of transactions and support multiple assets. This makes it a compelling option for institutional clients who require a high level of performance and scalability in their digital asset custody and DeFi activities.

Qredo is a partner with some of the largest names in crypto including Metamask and Coinbase to pave way for the future of institutional DeFi.

The blockchain journey for institutional investors has just started. Already, it has enabled the development of innovative financial products and services that have unlocked new opportunities for both individuals and institutions. It has also opened up a new world of possibilities for the financial industry, allowing for greater access to capital, increased liquidity, and improved transparency. As the industry continues to mature, an exciting future is promised.