As the second decade of the 21st century came to an end, a global pandemic swept human civilization and shook up the status quos of almost every single aspect of the existing system. Among which, climate change takes center stage as it is widely believed as a likely cause of the pandemic. All of a sudden, tackling climate crises becomes a top priority for nations and international bodies around the globe. At COP26, attending countries agreed to keep alive the prospect of limiting global warming to 1.5°C above pre-industrial levels. A year later at COP27, the vows were renewed and more resources were pledged to the cause. In the midst of heightened geopolitical risks, tightening monetary policies and broad economic slowdown, ClimateTech has become the new economic engine that drives future growth.

Carbon market in the spotlight

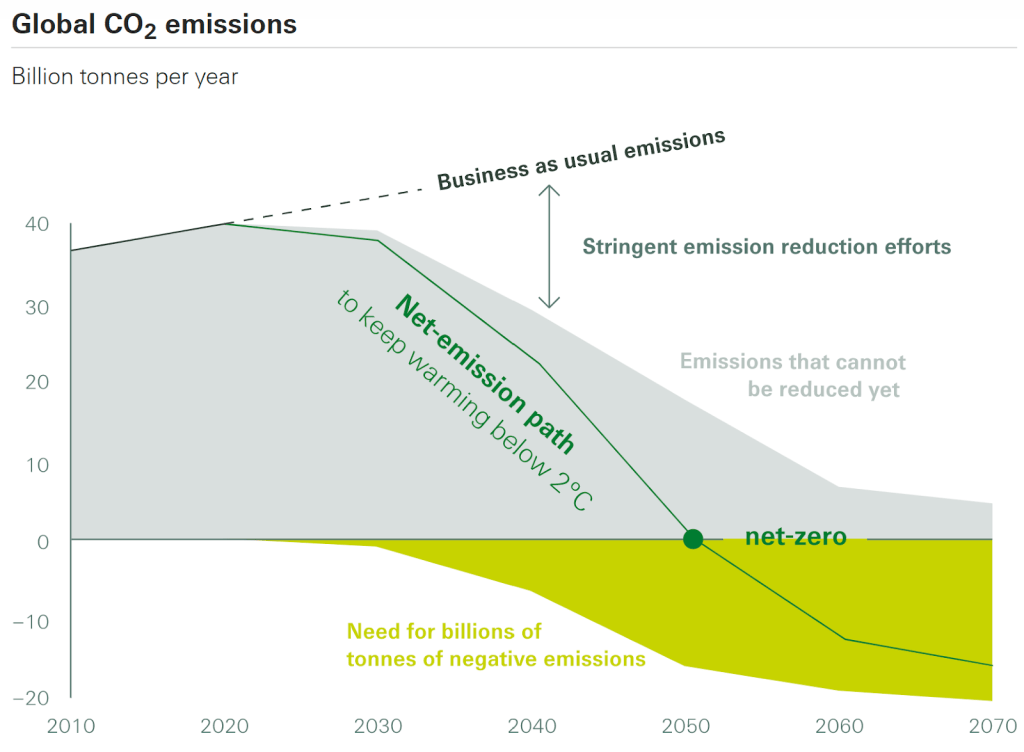

To achieve Net Zero goal by 2050, carbon emission has to go down, significantly. While governments around the globe are slowly rolling out compliance carbon markets to curb heavy polluters, many businesses fall out of the scope. The carbon reduction/offsetting activities outside of the compliance schemes collectively form the voluntary carbon market. It plays a crucial part in achieving carbon neutrality. The current voluntary carbon market is broken. There is no data transparency or universally agreed standards. From a supplier perspective, it is really difficult to communicate the quality of a carbon offset project due to the lack of data transparency and standardization. From buyer perspective, market access is restricted as transactions have to be done via brokers with significant brokerage fees. On top of that, buyers don’t always know what they are getting themselves into and are vulnerable to reputational risk. The complexity represents a huge market opportunity for climate talents and investors. Three key trends in the fast-evolving carbon market:

Carbon accounting is the most popular

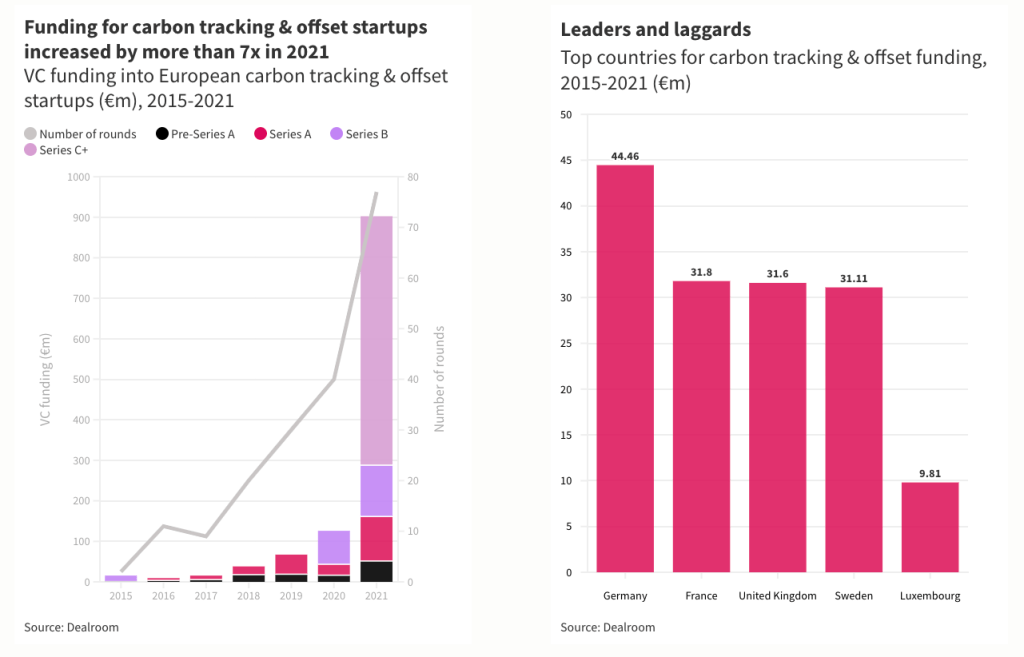

As ESG reporting becomes mandatory in more countries and regions, businesses large and small are working rapidly to fill the knowledge gap and to stay compliant. Accurate reporting requires proper carbon accounting of scope 3 emissions and more. To meet this latent demand, many startups have dedicated themselves to develop carbon accounting softwares. Many data points indicated that Carbon accounting is the subsector attracted the most fundings within the carbon technologies space. In April 2022, France-based Sweep raised $73 million to become the best funded Carbon Accounting platform in Europe. Its US peer Persefoni raised $114 million in total to continue to work on the cause.

Carbon offset vs. carbon removal

As the controversy around carbon offset continues to rise, deep-pocket investors have turned their attention to more permanent solutions – carbon removal technologies. While nature-based projects such as reforestation and soil storage are cheap and affordable carbon offset choices. The carbon sequestration is more short-term in nature. As the emphasis on quality solutions continues to rise, more and more investors have set up dedicated resources to develop carbon removal technologies.

Carbon credit x web3

The crypto stigma is hard to shake off, especially in light of recent events. Yet for the believers, blockchain technology has a real use case in the fight against climate change. The major properties of blockchain technology: immutable, traceable and decentralization make it a perfect candidate to modernize carbon credit market.

Climate hardware needs more attention

Marc Andreessen famously said: “Software is eating the world.” It then went on to rule the next decade of venture investing. While the Silicon Valley playbook has trained every investment firm to look for opportunities in software, software alone cannot solve the crises we are facing. To start, the direct solution to stop climate change is to replace the existing infrastructure which means replacing most if not all hardware in place. In this sense, Climate hardware represents a huge market opportunity and faces low demand risk. The market knows it needs new hardware and is waiting for the right products to come along. Furthermore, an active secondary market featured by active M&A activities and exit vehicles (SPACs) has significantly lowered the investment risk. With that being said, the high upfront investment and longer payback period remain the reality for hardware investors.

Within the hardware space, cleantech such as fusion and nuclear receive most attentions. Carbon removal solutions such as direct air capture is another one to watch.

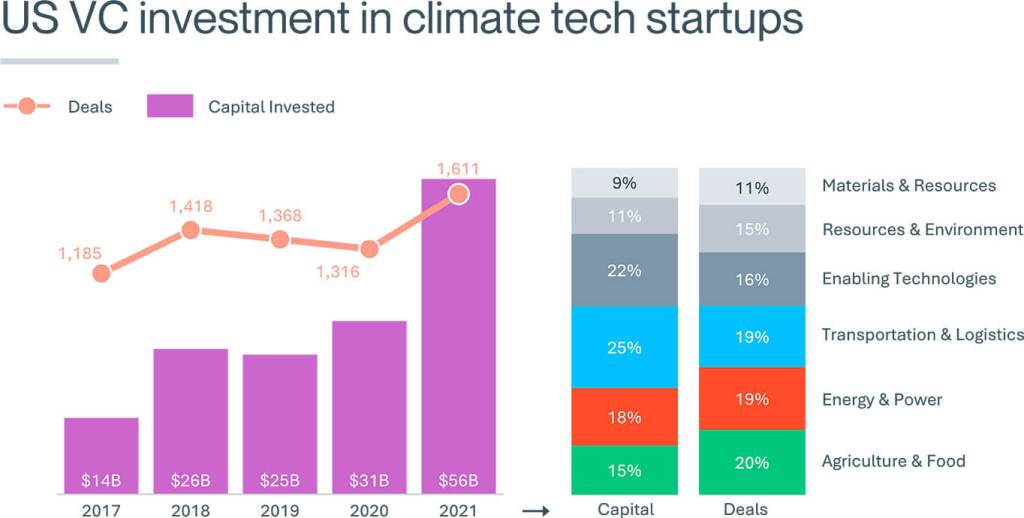

VC investment surges

According to Silicon Valley Bank, US VC funding for ClimateTech startups reached $56 billion in 2021, an 80% increase from 2020 or 4x as much as 2017 VC funding. In Europe, the numbers are more or less in line.

The passing global pandemic alarmed humanity about its existential risk. The threat is real and pressing. In order to survive, sustainability and climate risk need to be incorporated into every single aspect of human society. Welcome to the new industrial revolution.