The data storage vertical perhaps is not the most exciting compare to meme tokens or NFTs. But it is one of the most powerful use cases of blockchain. Anyone recall the American series Silicon Valley? The technology Richard tried to build bears lots of similarities to the decentralized storage technology today.

Backdrop

A simple google search tells me that roughly 2.5 quintillion bytes of data are created every day. To be more intuitive, that is 2,500,000,000,000,000,000 bytes of data! What is more alarming is that all these data are hosted by a handful of gigantic technology companies. Yes, the FAANG. This extreme concentration has led to countless issues in the past with many incidents happening in 2020 when online activities suddenly spiked. One notable incident was the Google Outrage that happened on 20 August 2020. For a period of six hours, people can’t access files on Google Cloud or do anything with Google Ecosystem basically. Aside from access to information, the current system is also vulnerable to hacker attacks and inappropriate use of data. The status quo calls for a reliable and decentralized storage solution.

In a nutshell

Filecoin is a P2P data storage network with built in economic incentives to store files reliably. The miners provide storage space to earn filecoin; the users spend filecoin to buy storage space. A decentralized storage network has no single point of failure. It also safeguards free flow of information so that no authorities can manipulate or block data to their own benefits.

The novelties of Filecoin

The two main novelties of Filecoin are: 1) IPFS (InterPlanetary File System) and 2) Proofs-of-Storage.

IPFS is a blockchain-like file storage system. It changes the current location-based file search to content-based file search using hash as a key. The location-based file search is problematic. If the file has been moved or the server is offline, you won’t be able to retrieve the file. With IPFS however, you search the content directly. Whoever on the IPFS network has a copy of that content can send it to you. Filecoin is a blockchain protocol built on top of IPFS with economic incentives. Here is a great video explains how IPFS works.

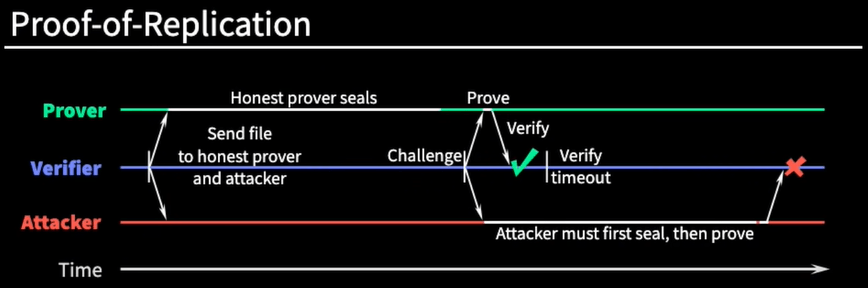

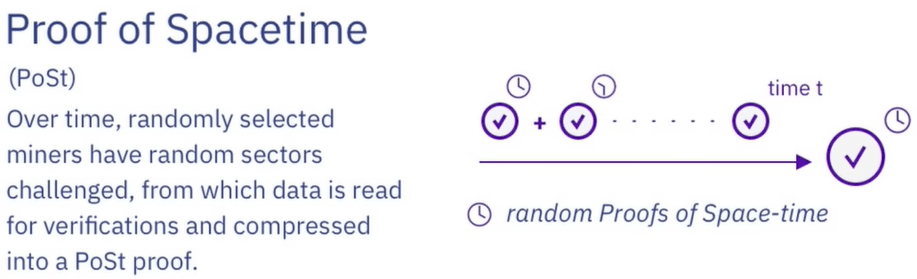

Proofs-of-Storage is the equivalent of Proof-of-Work on filecoin blockchain. The two Proofs-of-Storages on Filecoin are Proof of Replication (PoR) and Proof of Spacetime (PoSt). In order to earn the mining fee, the miners have to write proof to the filecoin blockchain to show that the file has been replicated to its unique physical storage (PoR). Since the miner can simply delete the data immediately after submitting the initial proof, miners are asked periodically to provide proof that they still hold the data (PoSt). For more details on Proofs-of-Storage, this is a great article.

The Investment Case of Filecoin

It is hard to not be excited about the ambition of Filecoin and what its success would mean to the internet in the future. It has a strong investment case for at least the following reasons.

A long-term project backed by unlimited capital

In a market that touts overnight millionaire stories and witnesses 5x, 10x return on a regular basis, it is refreshing to see a project that is in no rush to moon. Backed by unlimited capital, filecoin can afford to be patient. In fact, Filecoin has been chased by capital from the very beginning. It started in 2014 with $120k seed money from Y Combinator, followed by a $200 million ICO in 2017 with a stardust investor list. Sequoia, Winklevoss Capital, Union Square Ventures. And the list goes on. But it was not until October 2020 when filecion launched its mainnet. The current utility and capability targets are all set in 20 years’, or in some cases 30 years’ time.

Furthermore, Filecoin intentionally aligns stakeholder behaviors with its long-term goal by introducing lengthy vesting schedule. The vesting schedule for miners is six months, for early SAFT investors is 3 years and for founding teams is 6 years. For details on the vesting schedule, you can read more at Understanding Filecoin Circulating Supply.

A Deflationary Coin

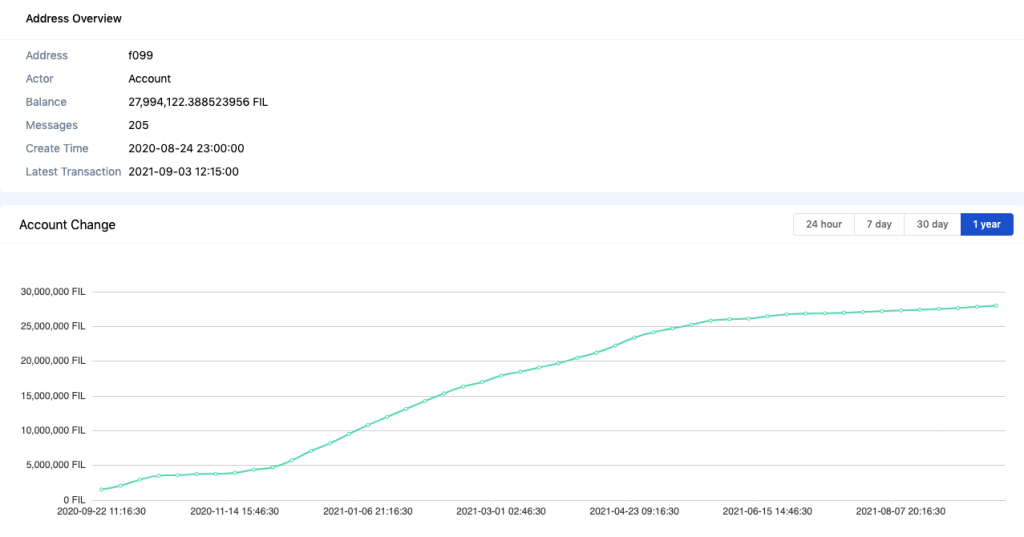

Many new investors who first come across filecoin are hesitated by its maximum supply of 2 billion. After all, the market cap is a function of supply and unit price. However, it is important to differentiate total supply and circulating supply. In Filecoin’s case, the circulating supply is a small portion of total supply. (more details at Understanding Filecoin Circulating Supply). Furthermore, the regular burn schedule makes sure that we will never get close to that number. Any rewards associated with unreliable storage space will be burned. If you want to check how many Filecoins have been burned so far, you can go to the burn address https://filfox.info/en/address/f099. As of 03 September 2021, around 28 million Filecoin have been burned with the network far from reaching its full utility.

An unparalleled network

Coming with the phenomenal founding team, investors list and advisory board is an unparalleled network that can open any doors for Filecoin. In fact, every single one of partnerships announced has been heavyweight.

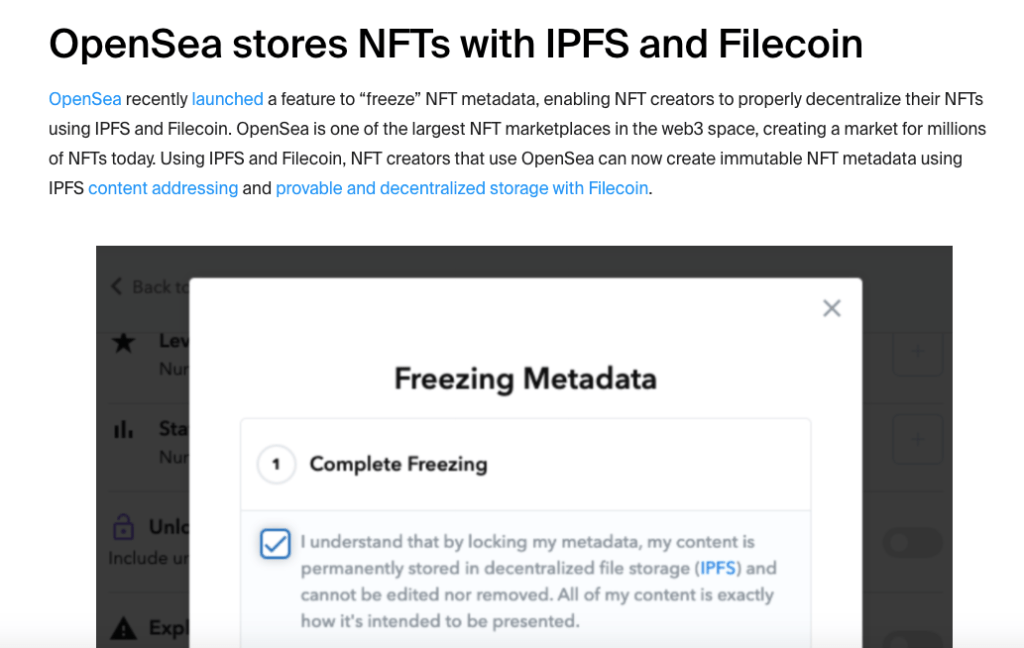

In June 2021, Filecoin announced that Opensea has launched the “Freezing Metadata” feature using IPFS and Filecoin.

March this year, Filecoin announced integration with Chainlink to bring advanced storage solutions to web 3.0.

And these are only two examples.

Food for thoughts

Will Filecoin price spike in the coming weeks? I can’t say for sure. It might given the next production cut is scheduled for 15 October. But for anyone who believes in the potential of decentralized storage technology and is willing to make long-term bets, Filecoin is a project worth consideration.