Lending & borrowing is one of the most explored use cases in DeFi. Here I want to share three different DeFi protocols that seek to deliver lending & borrowing services using three different mechanisms.

The Pioneer: MakerDao

Many consider MakerDao as the very first DeFi project. MakerDao is a Lending & Borrowing Protocol that is built on the Ethereum platform. It was created by The Maker Foundation in 2014 and managed by people around the world who hold its governance token MKR. There are slightly less than one million MKR tokens in circulation. The MKR token holders vote to decide on: add a new collateral asset, change the risk parameters of one or more collateral assets, modify the Dai Saving Rate etc. For more information on Maker Governance, please visit the white paper.

MakerDao runs the Maker Protocol: the Multi-Collateral Dai (MCD) System. Dai is the Maker Protocol’s stablecoin, soft pegged to USD. Dai is used to settle debt and debt service costs within the Maker Protocol. How Dai is generated? Dai is generated and kept stable by locking collateral assets into Maker Vaults on the Maker Protocol.

MakerDao adopts an overcollateralization model. It means that the collateral value always need to be kept greater than the borrowed amount. In scenarios the collateral value drop below the liquidation ratio, the vault will be liquidated to fulfill the debt obligation. For example, the Ethereum (ETH) Vault has a liquidation ratio/minimum collateralization ratio of 150%.

Key components of a Maker Vault:

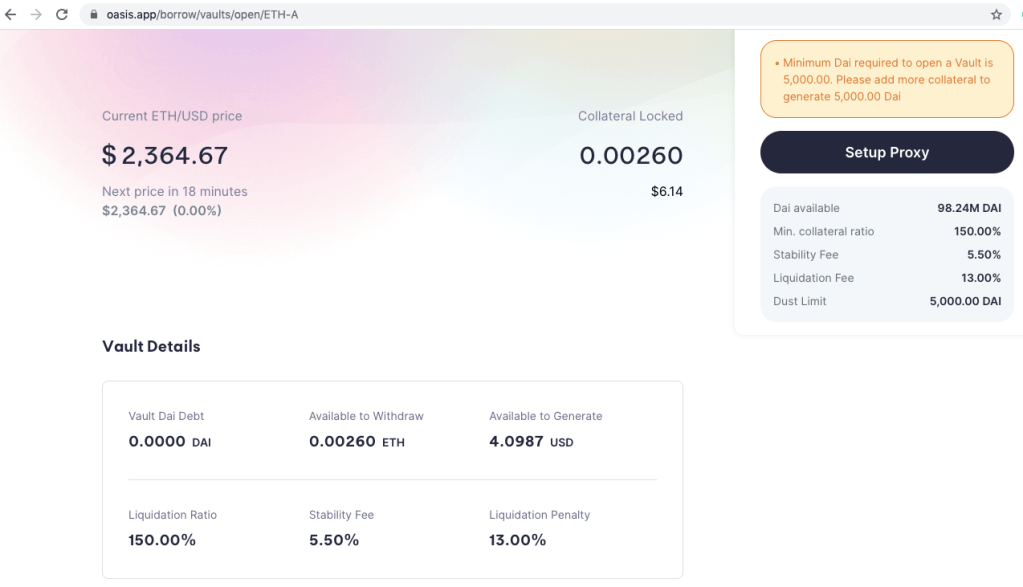

Dust Limit The minimum amount you need to open a Vault on Oasis Borrow (MakerDao’s borrowing and lending platform). The current dust limit is 5,000 Dai or $5,000.

Liquidation Ratio or Collateralization Ratio The minimum collateral-to-loan value ratio you need to maintain in order to prevent your Vault going into liquidation mode. The ratio is always greater than 100%. However, the specific ratio depends on the risk profile of a particular asset. The risk profile of each asset is collectively decided by MKR holders. It is typically between 130% – 150%.

Stability Fee The interest charged on the borrow. Again, the stability fee varies depends on the popularity of each asset.

Liquidation Penalty The Penalty charge a user needs to pay when the collateral-to-loan value dropped below the liquidation ratio. The liquidation penalty ratio is currently 13%.

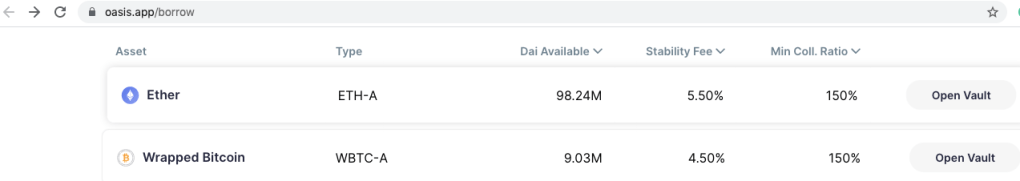

The following snapshots are taken from Oasis home page. The first snapshot shows that the stability fees can vary vault by vault. The second snapshot shows what a Maker Vault looks like.

What on earth will someone want to lock up more assets to issue a lower value loan in DAI? There are three possible use cases:

1. You need cash now and you are confident that the assets you lock in now will go up in value;

2. You need cash now but do not want to trigger a tax event by selling your assets;

3. You want to do leveraged investment by creating a Maker Vault on the back of the asset type you believe will go up in value. For example, if you believe the value of Ethereum will continue to go up, you can issue DAI to buy more Ethereum by locking in the Ethereum you already own.

Drawbacks

The biggest drawback of MakerDao is that over half of DAIs are backed by USDC and WBTC, posting serious centralized risk to the protocol. Another smaller drawback is the cost coming with the governance design.

To Make It More Complex – Fei Protocol

Fei Protocol is the most complext borrow/lending protocol I have seen so far. It is theoretically sound, but went into serious troubles at launch.

We asked the question earlier: why would someone want to lock up more assets to issue a lower value loan? It is indeed capital inefficient. Fei Protocol is an experimental project that explores a new mechanism that aims to mitigate the drawbacks of both overcollateralization and non-collateralization stablecoins.

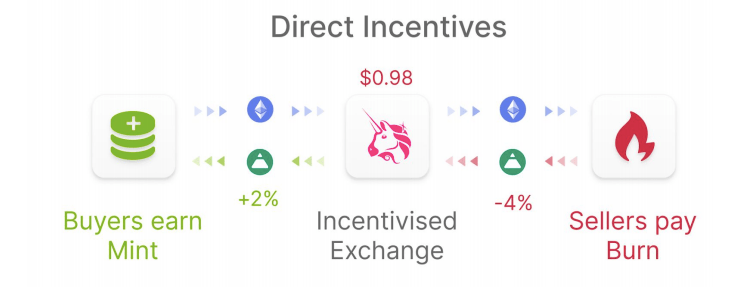

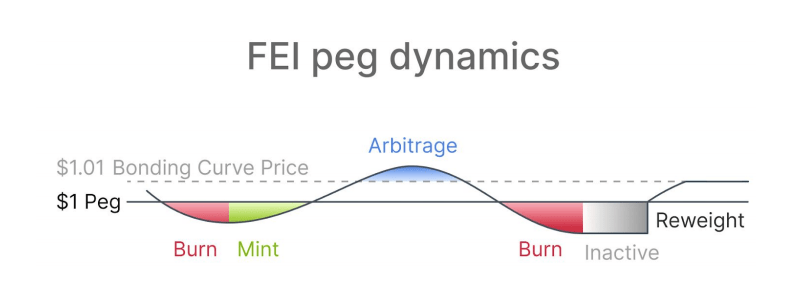

So how does it work? The protocol issues FEI stablecoin which is pegged to USD and it only accepts Ethereum as the collateral asset. The protocol aims to maintain a liquid market in which ETH/FEI trades closely to the ETH/USD price. To achieve this, it introduces a new stability mechanism known as direct incentives. When FEI price dropped below $1.00, the sellers will receive a penalty by selling FEI and buyers will earn rewards by purchasing FEI, vice versa. To avoid “mercenary capital” problem that is prevalent in pure user-own TVL (Total Value Locked) model — capital flee when APY decreases, FEI also introduces a new concept PCV (Protocol Controlled Value), a subset of TVL in which the protocol outright owns the assets without IOU. PCV is irrevocable and not profit-driven. Therefore, at sufficient volume level, PCV can be used to maintain a pair of exchange rate, in this case it is FEI and USD. It is a bit like Treasury Department buys and sells government bonds to regulate money supply.

What didn’t work? The direct incentive mechanism didn’t work at launch. The stablecoin struggled to hit its peg. The problem lies in its penalty mechanism. Every time a reweight happens, users rush to sell as that is the best price you are going to get. And of course the rush to sell makes the price drops further. Some serious game theory lessons learned here.

Two months post the launch drama, FEI price has stabilized. However, TVL has gone down significantly with a collateralization ratio (PCV/TVL) above 3x. It is unclear where FEI is heading with its market capitalization ranked outside of top 200. However, it is a brave and noble experiment and we shall keep an eye on its development.

To Make It Simpler – Liquity

Among all three, Liquity is the easiest to understand. At least that is the case for me.

Liquity is a capital efficient and interest-rate-free borrowing protocol. Similar to FEI protocol, it adopts a single collateral model, by pegging stablecoin LUSD to Ethereum. This makes the protocol truly decentralized, liquid and scalable. Unlike MakerDAO and FEI protocol, it does NOT have a governance token. Liquity is complete governance free thus saving the governance overheads. Other key features include:

Zero interest rate Liquity does not charge an interest rate on the borrow. Instead, it charges a fee upfront. The amount varies depends on supply and demand, but it is usually 0.5%. This gives borrower great clarity as you no longer need to keep an eye on the accumulated interest charges. Is this fee model cheaper than traditional interest rate model then? It depends. In general, if you are doing a short-term borrow (a few days and less than a month), it is likely better to use the interest rate loans. But if you are looking for long-term borrow, zero-interest-rate model saves you a lot of money.

Decentralized frontends In the spirit of being a truly decentralized project, Liquity does not run its own frontend either. It invites third party provider to provide frontend by offering a kickback fee.

Putting It All Together

The following is a quick snapshot of the key statistics of the three lending/borrowing projects. Launched around the same time (April 2021), Liquity is having a significant lead over FEI judging by TVL, a key evaluation metric of DeFi projects.

| Protocol | Collateral Assets | Collateralization Ratio | Interest Rate | Governance Token | Stablecoin | Total Value Locked (TVL) |

| MakerDao | Multi-Assets (ETH, USDC, WBTC etc.) | ~110% – 150% | 3% – 10% | MKR | DAI | $6.78 billion |

| FEI | Single (Ethereum) | Variable (PCV/User circulated FEI) | Variable | TRIBE | FEI | $560 million |

| Liquity | Single (Ethereum) | ~110% | Free (Upfront fee applies, usually 0.5%) | None, LQTY is its reward token. | LUSD | $2.1 billion |

That is all on the three main lending/borrowing projects. Look forward to seeing more innovative DeFi projects coming out in the future.